This article is in part based on http://www2.stat.duke.edu/~sayan/Sta613/2017/lec/LMM.pdf.

In this post we describe how linear mixed models can be used to describe longitudinal trajectories. An important linear model, particularly for longitudinal data, is the linear mixed model (LMM). The basic linear model assumes independent or uncorrelated errors for confidence intervals and a best linear unbiased estimate via ordinary least squares (OLS), respectively. However, often data is grouped or clustered with known group/cluster assignments. We expect that observations within a group/cluster will be correlated. An LMM provides an elegant model to handle this grouping.

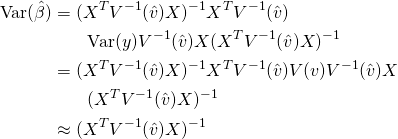

For a static example, say you have a counseling program for smoking and you want to model the effect of some covariates (age, weight, income, etc) on lapse frequency. You have a number of different counselors and each participant is randomized to a different counselor. You expect that both the baseline response and how covariates affect the response varies across counselors. Here the group is the counselor. For a longitudinal example, say you have a number of HIV/AIDS patients and you track their white blood cell counts over time. You want to model the effect of time on white blood cell counts. You expect that the white blood cell count at the start of measurement and the effect of time on the white blood cell count vary between individuals. In this case, the group or cluster is the individual: repeated observations within an individual are correlated.

Intuition

In an LMM for longitudinal data, the observed process is a noisy realization of some linear function of time and possibly other covariates. Further, every individual patient has some deviation from the global behavior. In the HIV/AIDS case, every patient has a different smooth underlying true trajectory, and their observed white blood cell counts are noisy measurements of this true trajectory. We want to first estimate the average trajectory, described by the fixed effects or global parameters ![]() . Then we estimate the individual specific deviations from the average trajectory, described by the random effects or latent variables per patient

. Then we estimate the individual specific deviations from the average trajectory, described by the random effects or latent variables per patient ![]() . These definitions of fixed and random effects come from the biostatistics literature: in econometrics fixed and random effects mean something else.

. These definitions of fixed and random effects come from the biostatistics literature: in econometrics fixed and random effects mean something else.

The Model

Scalar Representation

Assume that we have ![]() patients or participants in a study, and for each participant, we have

patients or participants in a study, and for each participant, we have ![]() observations, where the indexing orders them in time. To start with we look at the case where non-transformed time is the only covariate. Let

observations, where the indexing orders them in time. To start with we look at the case where non-transformed time is the only covariate. Let ![]() be the health measurement value for patient

be the health measurement value for patient ![]() at observation

at observation ![]() : this could be the CD4/white blood cell count in AIDS. Then the LMM takes the form

: this could be the CD4/white blood cell count in AIDS. Then the LMM takes the form

(1)

and

- Let

. Then

. Then  .

. - Let

. Then

. Then

- We also assume that all random effect and error vectors are independent from each other. That is,

are independent. This is saying that within a patient, random effects are independent of errors, and that we have independence across patients.

are independent. This is saying that within a patient, random effects are independent of errors, and that we have independence across patients.

Here ![]() are the fixed effects, and

are the fixed effects, and ![]() are the random effects, with

are the random effects, with ![]() and

and ![]() . The fixed effects can be thought of as the average effects across patients (global parameters in machine learning terminology), while the random effects are the patient specific effects (latent variables per person). The term

. The fixed effects can be thought of as the average effects across patients (global parameters in machine learning terminology), while the random effects are the patient specific effects (latent variables per person). The term ![]() is called the random intercept, and

is called the random intercept, and ![]() is the random slope.

is the random slope.

As you may have noticed, we made normality assumptions. In the standard linear regression model with only fixed effects ![]() and without random effects, normality assumptions are not necessary to estimate

and without random effects, normality assumptions are not necessary to estimate ![]() , although they are necessary for confidence intervals when the sample size is small. However, in the mixed model setting, while they are not necessary to fit

, although they are necessary for confidence intervals when the sample size is small. However, in the mixed model setting, while they are not necessary to fit ![]() , they are necessary to derive predictions for

, they are necessary to derive predictions for ![]() , as we shall see.

, as we shall see.

Vector and Matrix Representation

We can extend this to a vector-matrix representation along with more features. In the longitudinal case these features may be rich basis functions of time. Let ![]() be the covariate vector for fixed effects for patient

be the covariate vector for fixed effects for patient ![]() at observation

at observation ![]() , along with a

, along with a ![]() in the first position. Let

in the first position. Let ![]() be the same for random effects. In many cases, both of these are simply basis functions of

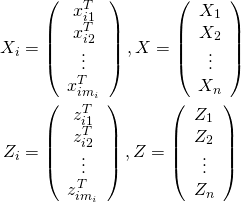

be the same for random effects. In many cases, both of these are simply basis functions of ![]() . We can then define

. We can then define

(2)

Here ![]() is the design matrix for for the fixed effects and

is the design matrix for for the fixed effects and ![]() is the design matrix for random effects. Let

is the design matrix for random effects. Let ![]() be the vector of all observations, where

be the vector of all observations, where ![]() , and similarly for

, and similarly for ![]() . Further, let

. Further, let

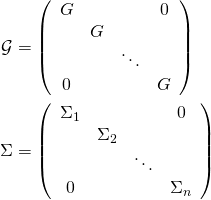

(3)

Then the model is

(4)

where we make the assumptions

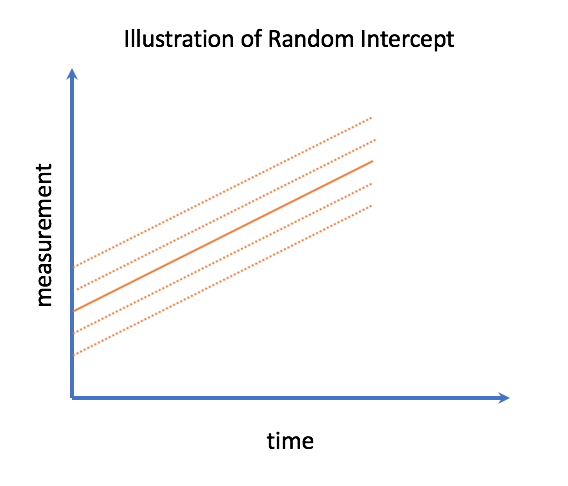

Random Intercept

In a longitudinal setting a random effect which is not associated with a covariate is called the random intercept, and has an important interpretation. It is the deviation from average for the ‘true’ trajectory when they’re first observed. In the HIV/AIDS case, this is how much a patient’s starting health values deviates from average when they enter the study.

, or more generally when all covariates have value

, or more generally when all covariates have value  .

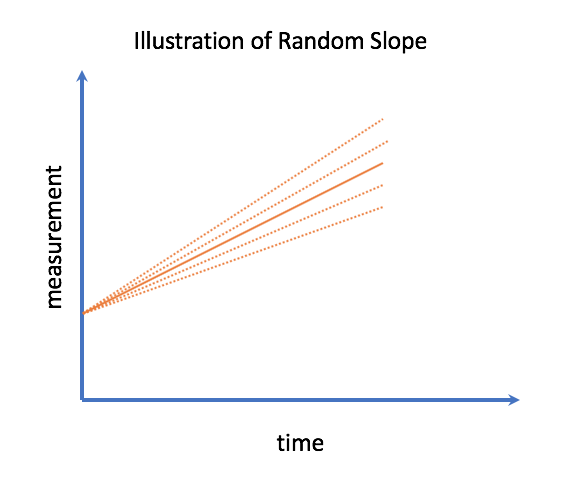

.Random Slope

In the case of a single covariate, particularly non-transformed time, we can call the other random effect the random slope. This describes how the rate of evolution of the health process deviates from the average person.

Estimation and Prediction

We first describe how to estimate ![]() when both the covariance matrices for random effects

when both the covariance matrices for random effects ![]() and for errors

and for errors ![]() are known. Then we describe how to predict

are known. Then we describe how to predict ![]() . In practice,

. In practice, ![]() and

and ![]() are not known, so we then show how to estimate them. Finally, we show how to fit confidence intervals.

are not known, so we then show how to estimate them. Finally, we show how to fit confidence intervals.

Known Covariance Matrix

Expressing the Linear Mixed Model as Gaussian Linear Regression

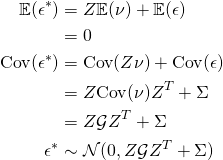

We can express the model described in part I with fixed and random effects as a Gaussian linear regression problem with only fixed effects (no random effects). Here, however, the covariance matrix between error terms is not only heteroskedastic, but non-diagonal. To see how, consider

(5)

Then since ![]() , we have

, we have

(6)

With ![]() and

and ![]() , we have a Gaussian linear regression model. However, the linear regression assumption of independent homoskedastic (equal variance) errors is violated. In particular, for the covariance

, we have a Gaussian linear regression model. However, the linear regression assumption of independent homoskedastic (equal variance) errors is violated. In particular, for the covariance ![]() , we can have both non-identical diagonal elements (heteroskedasticity) but also correlation between elements of

, we can have both non-identical diagonal elements (heteroskedasticity) but also correlation between elements of ![]() . We call this Gaussian linear regression setup the marginal model.

. We call this Gaussian linear regression setup the marginal model.

Estimating  : Generalized Least Squares

: Generalized Least Squares

While ordinary least squares is not the best linear unbiased estimator (BLUE) in the presence of correlated heteroskedastic errors, another estimation technique, generalized least squares (GLS), is. Let ![]() be the covariance matrix for

be the covariance matrix for ![]() . Then the GLS estimate is given by

. Then the GLS estimate is given by

(7)

For a derivation of this estimator, see http://halweb.uc3m.es/esp/Personal/personas/durban/esp/web/notes/gls.pdf.

Predicting

Since ![]() is a random or local latent vector rather than a fixed parameter, we want to predict

is a random or local latent vector rather than a fixed parameter, we want to predict ![]() rather than estimate it. One prediction we can use is

rather than estimate it. One prediction we can use is ![]() . We can calculate this in three steps:

. We can calculate this in three steps:

- Note that

and

and  are jointly multivariate normal

are jointly multivariate normal - Compute the covariance between them and get the full joint distribution of the random vector

.

. - Use properties of the multivariate normal to get the conditional expectation

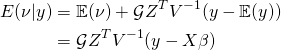

In order to compute the covariance between them, note that

(8)

This gives us that ![]() .

.

We can then use the conditional expectation for a multivariate normal (see https://stats.stackexchange.com/questions/30588/deriving-the-conditional-distributions-of-a-multivariate-normal-distribution) to obtain

(9)

This is the best linear unbiased predictor (BLUP). To see a proof, see https://dnett.public.iastate.edu/S611/40BLUP.pdf. Next we show what to do when the covariance parameters are unknown.

Unknown Covariance Matrix

Maximizing the Likelihood

One way to estimate ![]() is to maximize the likelihood. Recall that we have the marginal model

is to maximize the likelihood. Recall that we have the marginal model ![]() with

with ![]() , where

, where ![]() is the design matrix for random effects. Let

is the design matrix for random effects. Let ![]() . We can assume that both

. We can assume that both ![]() and

and ![]() are parametrized by variance components

are parametrized by variance components ![]() , so that

, so that

(10)

We can then consider the joint log-likelihood of ![]() and

and ![]() , given by

, given by

(11)

however we want to estimate ![]() , so

, so ![]() is a nuisance parameter. It is difficult to maximize the joint likelihood directly, but there is an alternate technique for maximizing a joint likelihood in the presence of a nuisance parameter known as the profile likelihood. The idea is to suppose that

is a nuisance parameter. It is difficult to maximize the joint likelihood directly, but there is an alternate technique for maximizing a joint likelihood in the presence of a nuisance parameter known as the profile likelihood. The idea is to suppose that ![]() is known, and then holding it fixed, derive the maximizing

is known, and then holding it fixed, derive the maximizing ![]() . We can then substitute

. We can then substitute ![]() with

with ![]() in the likelihood, giving us the profile log-likelihood

in the likelihood, giving us the profile log-likelihood ![]() , which we maximize with respect to

, which we maximize with respect to ![]() . The profile likelihood is the joint likelihood with the nuisance parameter expressed as a function of the parameter we want to estimate. As in the above, often this function is the likelihood maximizing expression for the nuisance parameters.

. The profile likelihood is the joint likelihood with the nuisance parameter expressed as a function of the parameter we want to estimate. As in the above, often this function is the likelihood maximizing expression for the nuisance parameters.

Let ![]() be the likelihood with

be the likelihood with ![]() fixed. Overall, we are evaluating the following

fixed. Overall, we are evaluating the following

(12)

This gives us the maximum likelihood estimate ![]() . For more on the profile log-likelihood, see https://www.stat.tamu.edu/~suhasini/teaching613/chapter3.pdf.

. For more on the profile log-likelihood, see https://www.stat.tamu.edu/~suhasini/teaching613/chapter3.pdf.

It turns out that the maximum likelihood estimate ![]() for

for ![]() is biased. However, an alternative estimate, the restricted maximum likelihood, is unbiased.

is biased. However, an alternative estimate, the restricted maximum likelihood, is unbiased.

Restricted Maximum Likelihood

The idea for the restricted maximum likelihood (rMEL) for LMM is that instead of maximizing the profile log-likelihood, we maximize the marginal log-likelihood, where we take the joint likelihood and integrate ![]() out. Note that this is not the standard intuition for rMEL, but it works for Gaussian LMM. For a more general treatment, see http://people.csail.mit.edu/xiuming/docs/tutorials/reml.pdf.

out. Note that this is not the standard intuition for rMEL, but it works for Gaussian LMM. For a more general treatment, see http://people.csail.mit.edu/xiuming/docs/tutorials/reml.pdf.

Let ![]() be the joint likelihood of

be the joint likelihood of ![]() and

and ![]() . Then we want to maximize

. Then we want to maximize

(13)

which is given by (see http://www2.stat.duke.edu/~sayan/Sta613/2017/lec/LMM.pdf for a full derivation)

(14)

maximizing this gives us the restricted maximum likelihood estimate ![]() , which is unbiased.

, which is unbiased.

Putting it all Together to Estimate  and predict

and predict

Finally, to estimate ![]() , we estimate the covariance matrix

, we estimate the covariance matrix ![]() from the above, and then estimate

from the above, and then estimate ![]() as

as

(15)

Similarly, to predict ![]() , we have

, we have

(16)

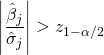

Confidence Intervals

Marginal Confidence Intervals for

Since ![]() and

and ![]() , we can derive the covariance matrix for

, we can derive the covariance matrix for ![]() .

.

(17)

In OLS, the variance of the estimator is a function of the true variance. Here, it is a function of both the true covariance and the estimate of the covariance. Further, in OLS we have an estimator for the error variance that is a scaled ![]() , which allows us to compute exact

, which allows us to compute exact ![]() marginal confidence intervals under Gaussian errors. We don’t have this here (as far as I know), so we use approximate marginal confidence intervals

marginal confidence intervals under Gaussian errors. We don’t have this here (as far as I know), so we use approximate marginal confidence intervals

(18)

This will tend to underestimate ![]() since we didn’t explicitly model the variation in the estimated variance components

since we didn’t explicitly model the variation in the estimated variance components ![]() . However as the sample size grows this will become less of an issue.

. However as the sample size grows this will become less of an issue.

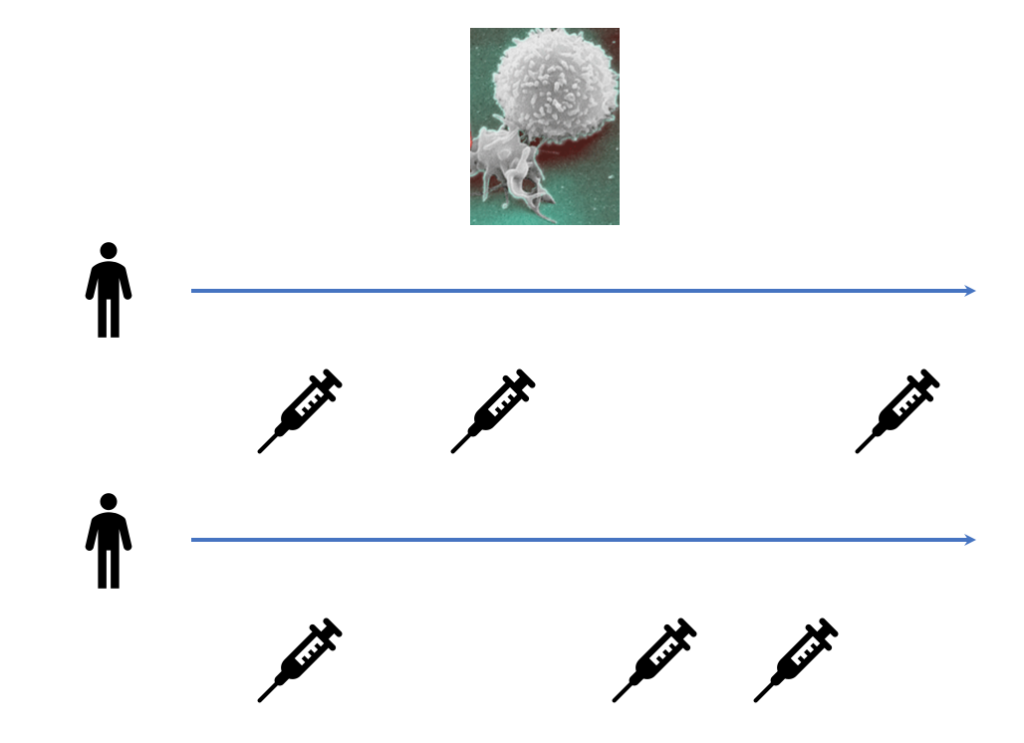

Hypothesis Test

We can test the null hypothesis that an individual coefficient is ![]() against the alternative that it is non-zero. That is, test

against the alternative that it is non-zero. That is, test ![]() versus

versus ![]() . Let

. Let ![]() . We reject the null

. We reject the null ![]() if and only if

if and only if

(19)

Unfortunately (as far as I know), the finite sample properties of this hypothesis test are not fully understood.